- #Best financial software for mac and rental income upgrade#

- #Best financial software for mac and rental income full#

- #Best financial software for mac and rental income pro#

- #Best financial software for mac and rental income plus#

During the 13 minutes I spent preparing a simple return, I encountered no fewer than three offers to upgrade.

#Best financial software for mac and rental income upgrade#

While the software offers many tips to help do-it-yourselfers, including a bot (known as the TurboTax Digital Assistant), you won’t have access to hands-on customer service unless you’re willing to upgrade to TurboTax Live.Īnd that’s another aspect of using TurboTax you should be aware of: near-constant urging to upgrade your package.

#Best financial software for mac and rental income pro#

Before filing your return, a tax pro will schedule a time to review your return with you.

#Best financial software for mac and rental income full#

You can also pay an additional fee to move to Full Service and have your tax return prepared for you. When you choose this option, the tax pro will do a final review of your return before you file. If you get stuck along the way, you have the option of paying an additional fee and upgrading to TurboTax Live to get on-demand help from a TurboTax expert or CPA.

Single taxpayer, no dependents, self-employment income, federal and state estimated tax payments: 30 minutesĭuring the process, a banner at the top of the screen keeps a running tally of your estimated federal and state refund or amount due.Įmbedded links on each screen offer tips, explain different income, deductions, and tax credits. :max_bytes(150000):strip_icc()/AppFolio-0d9986e1592547ed983ad5ae7f3b969d.jpg) Married couple filing jointly, one dependent, two W-2s, Child Tax Credit and child and dependent care credit: 20 minutes. Single taxpayer, no dependents, W-2 income and the student loan interest deduction: 13 minutes. Here’s how long it took me to get from start to filing for each one: The software walks you through the tax preparation and filing process with a series of interview-style questions.Īs part of my review process, I went through the process of preparing three sample returns. Preparing your tax return with TurboTax is a lot like sitting down with a tax preparer. If you want to pay your filing fee out of your federal refund, TurboTax charges an extra $39 refund processing fee for the convenience. 10, 2022, without any discounts that TurboTax may offer to people who file early in the tax filing season. These prices reflect the list prices advertised as of Feb. Everything included in the Self-Employed version, but a tax pro prepares your return for you. Everything included in the Premier version, but a tax pro prepares your return for you. Everything included in the Deluxe version, but a tax pro prepares your return for you. Everything included in the free version, but a tax pro prepares your return for you.

Married couple filing jointly, one dependent, two W-2s, Child Tax Credit and child and dependent care credit: 20 minutes. Single taxpayer, no dependents, W-2 income and the student loan interest deduction: 13 minutes. Here’s how long it took me to get from start to filing for each one: The software walks you through the tax preparation and filing process with a series of interview-style questions.Īs part of my review process, I went through the process of preparing three sample returns. Preparing your tax return with TurboTax is a lot like sitting down with a tax preparer. If you want to pay your filing fee out of your federal refund, TurboTax charges an extra $39 refund processing fee for the convenience. 10, 2022, without any discounts that TurboTax may offer to people who file early in the tax filing season. These prices reflect the list prices advertised as of Feb. Everything included in the Self-Employed version, but a tax pro prepares your return for you. Everything included in the Premier version, but a tax pro prepares your return for you. Everything included in the Deluxe version, but a tax pro prepares your return for you. Everything included in the free version, but a tax pro prepares your return for you. #Best financial software for mac and rental income plus#

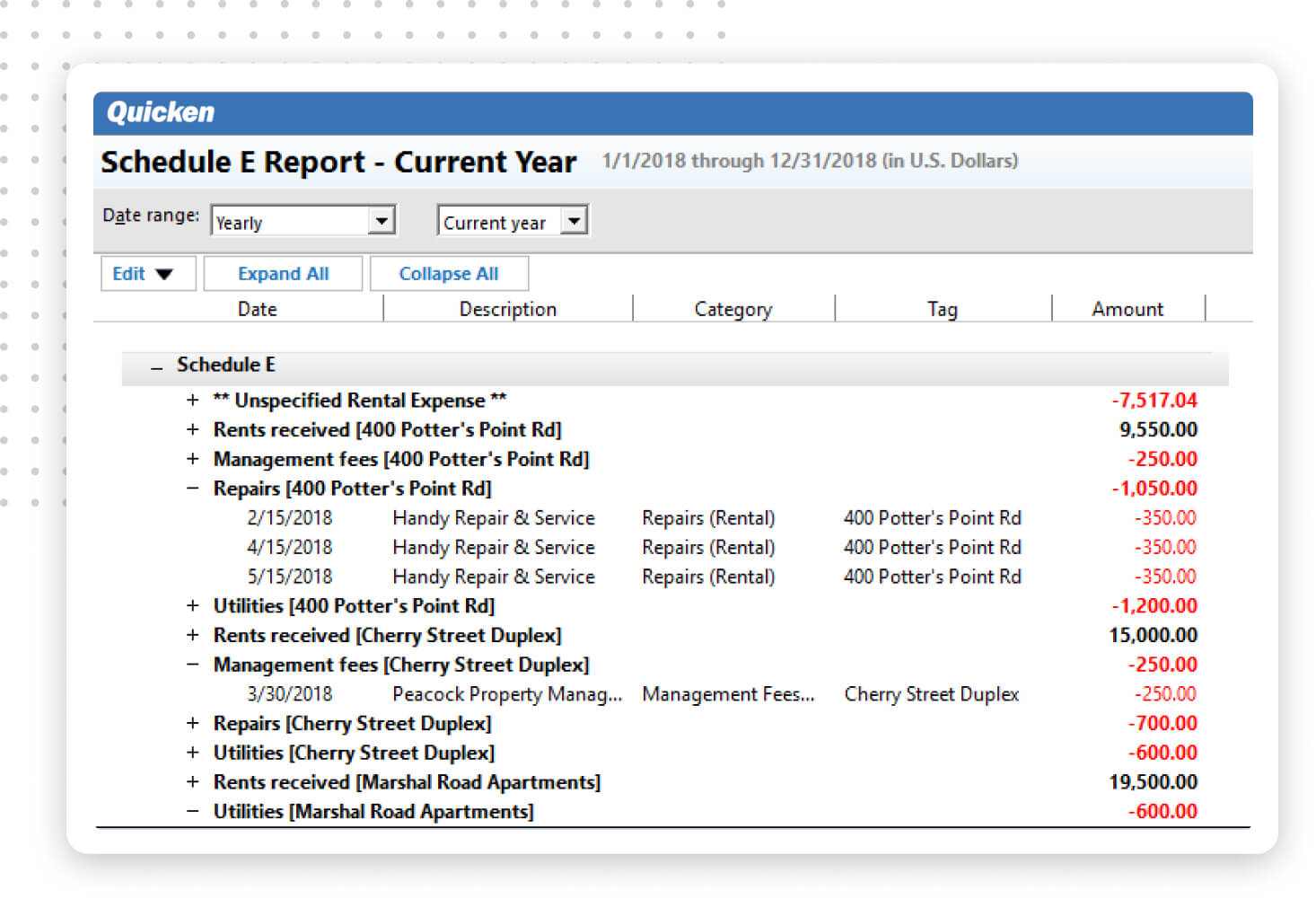

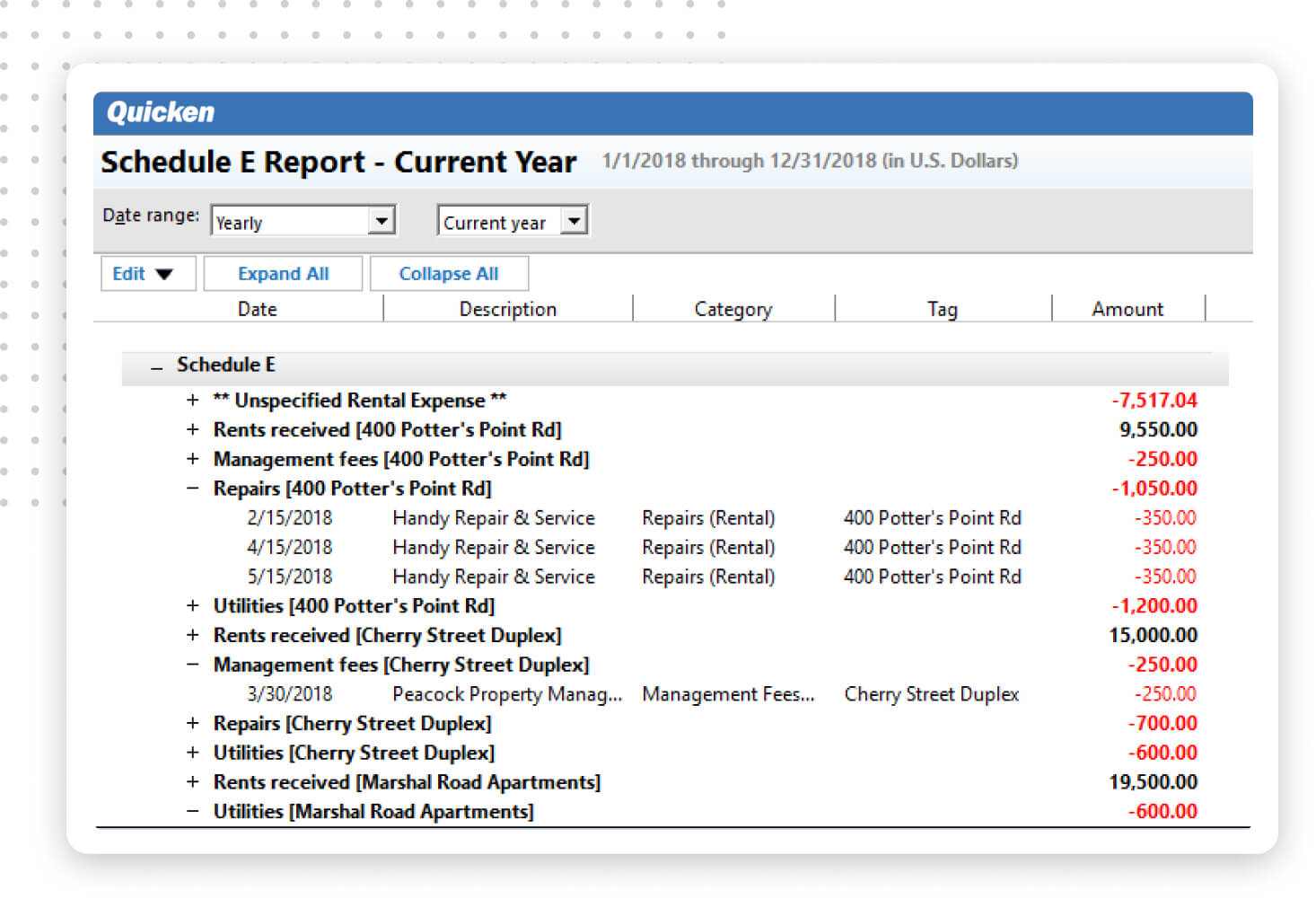

Everything included in Self-Employed, plus on-demand help from a tax pro via video and a final review of your self-prepared return. Everything included in Premier, plus on-demand help from a tax pro via video and a final review of your self-prepared return. Everything included in Deluxe, plus on-demand help from a tax pro via video and a final review of your self-prepared return. Essentially the free version but with on-demand help from a tax pro via video and a final review of your self-prepared return. Also works for the home office deduction. Allows reporting of income from a trade or business, contract work, and freelancing. Allows reporting of income and expenses from rental properties and pass-through businesses. Allows reporting of capital gains and losses.

Covers W-2 income, limited interest and dividend income, the Earned Income Credit, Child Tax Credit, the standard deduction, and student loan interest deduction.

Free filing of federal and state returns.

:max_bytes(150000):strip_icc()/AppFolio-0d9986e1592547ed983ad5ae7f3b969d.jpg)

0 kommentar(er)

0 kommentar(er)